BP Corporation North America, Inc., BP America Production Company, and BP Energy Company (collectively BP) Assessed a Penalty of $10,750,000 in Violation of the NGA Section 4A

Summary of NERC Penalties

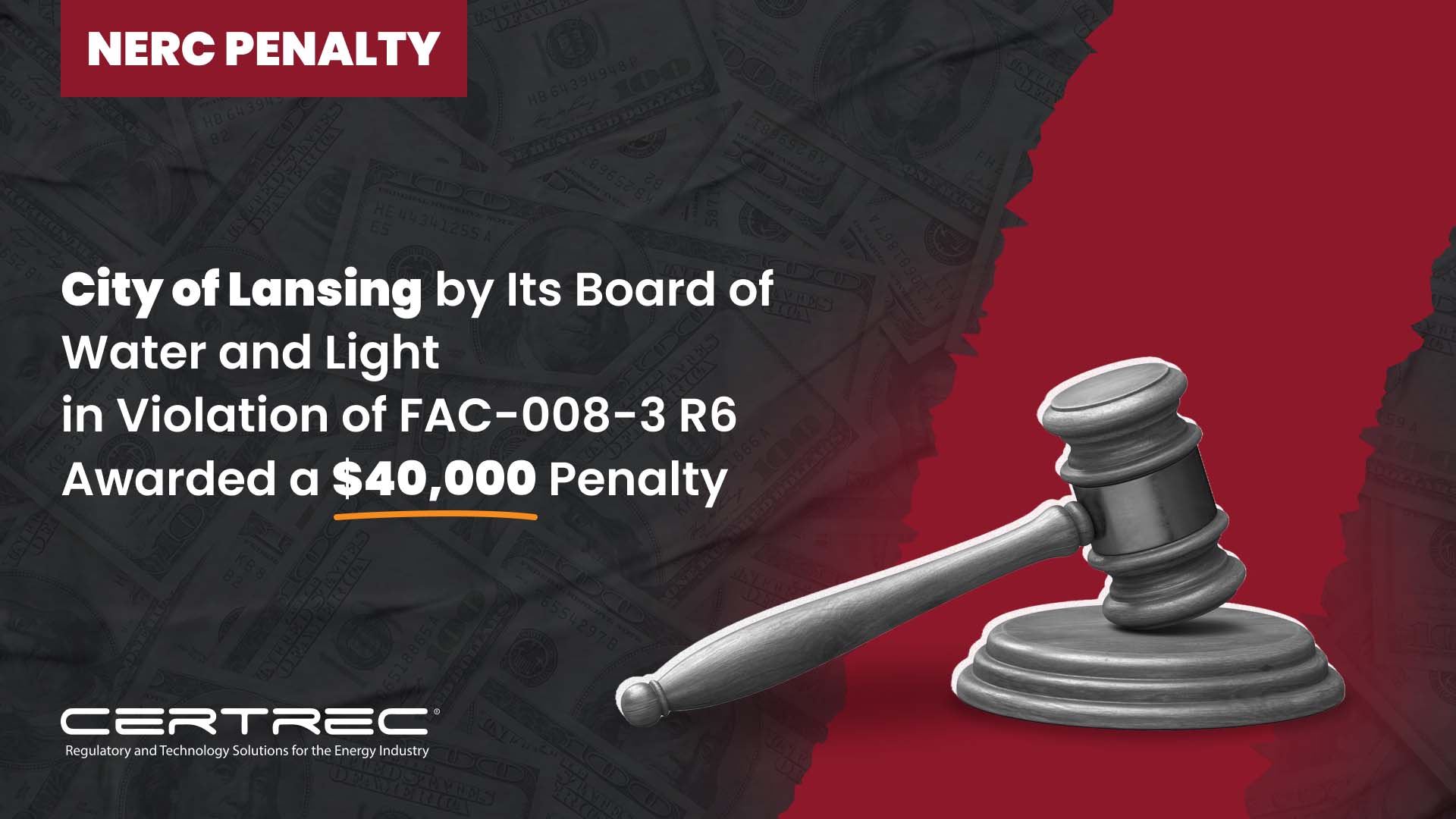

REGION | WHEN? | ENTITY | COMPLIANCE AREA | VIOLATION | REASON | PENALTY AMOUNT |

|---|---|---|---|---|---|---|

FERC | Quarter 3 - July 2023 | BP Corporation North America, Inc. | FERC's regulations | NGA section 4A and the Commission’s Anti-Manipulation Rule, 18 C.F.R. § 1c.1 | BP engaged in market manipulation in violation of NGA section 4A and the Commission’s Anti-Manipulation Rule, 18 C.F.R. § 1c.1, when it engaged in the trading that is the subject of this case | $10,750,000 |

After briefing by the Parties regarding the Initial Decision, the Commission on July 11, 2016, issued an Order on Initial Decision and Rehearing, pursuant to which it assessed a civil penalty against BP in the amount of $20,160,000, ordered disgorgement of $207,169, and denied the BP request for rehearing of the Order Establishing Hearing. 156 FERC ¶ 61,031 (2016). BP filed a timely appeal of the Commission order denying rehearing of the Order Establishing Hearing with the Fifth Circuit. This appeal was held in abeyance pending Commission action on the BP request for rehearing of the Order on Initial Decision and Rehearing.

BP sought rehearing of the order assessing the civil penalty, and the Commission on December 17, 2020, issued an Order Addressing Arguments Raised on Rehearing, denying rehearing. 173 FERC ¶ 61,239 (2020). On December 28, 2020, BP paid under protest the civil penalty, including interest, in the amount of $24,356,686. As of January 19, 2021, BP paid under protest disgorgement, including interest, in the amount of $250,295.

Based upon an appeal by BP, the Fifth Circuit affirmed the Commission in part, reversed the Commission in part, and remanded for the Commission to reassess the civil penalty in accordance with the Fifth Circuit ruling partially in favor of BP regarding the scope of the Commission jurisdiction over the challenged conduct.

Neither BP nor the Commission sought rehearing or rehearing en banc of the Fifth Circuit decision, and neither BP nor the Commission sought a writ of certiorari from the Supreme Court of the United States. The appeal decision resulted in a reduction in the amount of penalty assessed.

BP agreed to the Civil Penalty of $10,750,000 (which includes interest) and that it will not seek return of the disgorgement it already has paid. Because BP’s prior civil penalty payment was made under protest and exceeds the Civil Penalty to which the parties agree here, BP is not obligated to make any additional payment. Moreover, Enforcement will not object should BP choose to seek to reclaim the excess payment of $13,606,686 through a suit in the United States Court of Federal Claims or any other forum of competent jurisdiction, if any.

BP shall promptly notify Enforcement of any actions it takes to reclaim the excess payments. Such notice shall be by email to the Director of the Office of Enforcement, with a copy filed in the official docket of this proceeding.

About Certrec:

Certrec is a leading provider of regulatory compliance solutions for the energy industry with the mission of helping ensure a stable, reliable, bulk electric supply. Since 1988, Certrec’s SaaS applications and consulting expertise have helped hundreds of power-generating facilities manage their regulatory compliance and reduce their risks.

Certrec’s engineers and business teams bring a cumulative 1,500 years of working experience in regulatory areas of compliance, engineering, and operations, including nuclear, fossil, solar, wind facilities, and other Registered Entities generation and transmission.

Certrec has helped more than 200 generating facilities establish and maintain NERC Compliance Programs. We manage the entire NERC compliance program for 80+ registered entities in the US, Canada, and Mexico that trust us to decrease their regulatory and reputational risk. Certrec is ISO/IEC 27001:2013 certified and has successfully completed annual SOC 2 Type 2 examinations.

For press and media inquiries, please contact marketing@certrec.com.

Share