Regulatory due diligence, a critical step in acquiring new generating assets, is a collaborative effort involving investors, energy industry professionals, and, most importantly, regulatory compliance officers. This meticulous process is essential for ensuring that investments are viable, sustainable, and comply with the North American Electric Reliability Corporation (NERC) regulations. Ensuring due diligence and regulatory compliance requires detailed technical evaluations and comprehensive regulatory checks to avoid costly penalties. Regulatory due diligence verifies that the assets meet current regulatory standards, facilitating their successful integration into the energy grid. By addressing how to ensure due diligence and regulatory compliance, this thorough assessment empowers stakeholders to make informed decisions that promote long-term operational success.

Related blog: Understanding and Implementing Effective PRC-005 Compliance Strategies

Technical Regulatory Due Diligence of Infrastructure

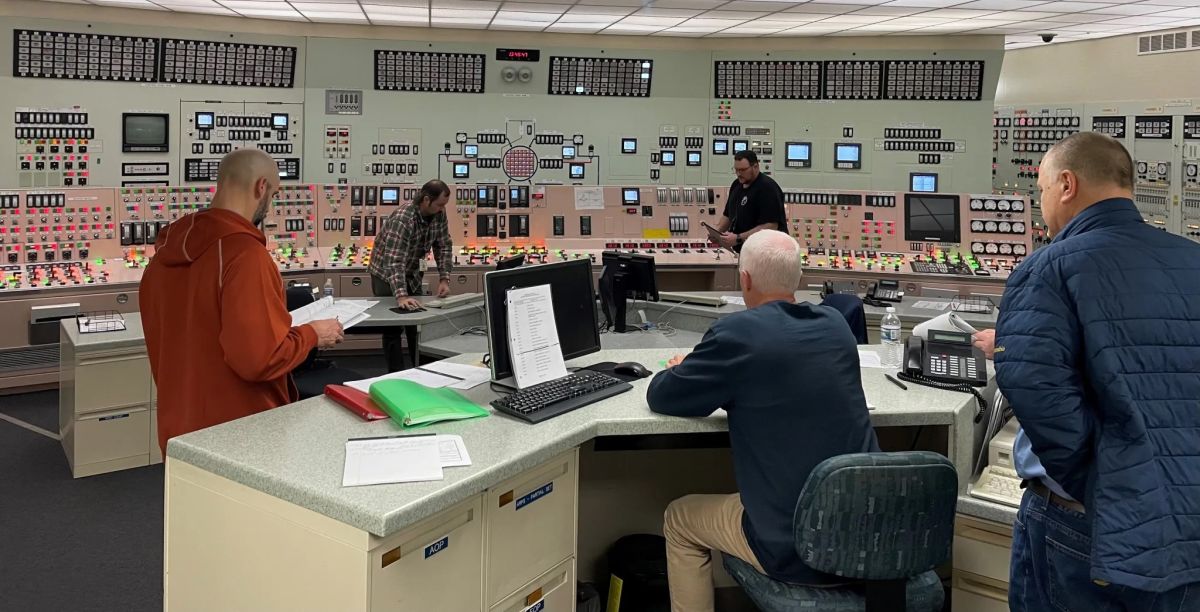

Technical due diligence focuses on the generating assets’ physical condition and operational efficiency. Such assessment includes examining the equipment’s age, maintenance history, and regulatory changes. Compliance with standards such as PRC-005 ensures proper testing of battery systems, protective relays, control circuitry, sudden pressure relays, and automatic reclosing. These assessments ensure that the infrastructure meets current standards and emphasize the importance of future readiness, ensuring the bulk electric system is protected and can support future upgrades or expansions.

Deloitte Energy Outlook 2024 highlights massive investments in advanced technologies like smart grids and renewable technologies like solar, wind, and hydrogen, which are not just trends but the future of the energy industry. This amplifies the need for thorough due diligence to ensure the technical suitability and future readiness of generating assets. As energy industry professionals, your role in ensuring the longevity and adaptability of these assets is crucial. Let’s work together to ensure our assets comply with current regulations and are ready for the future.

Risk Management and Mitigation Strategies

Effective risk management involves identifying potential risks, assessing their impact, and implementing mitigation strategies to protect the organization from significant financial and reputational damage. As a regulatory compliance officer, your role in implementing an internal compliance program is crucial, especially if the prospective generating asset does not have one. This step is essential in identifying and managing the risks of acquiring new generating assets. It strategically evaluates potential operational, regulatory, and environmental risks impacting asset performance and compliance. A deep understanding of regulatory change management, managing technological obsolescence, addressing environmental liabilities, and documentation of regulatory activities is critical. Management services such as contingency planning, insurance, and adaptation to regulatory shifts safeguard the asset’s value and operational integrity.

Financial Consequences of Improper Due Diligence

Performing proper due diligence helps to mitigate the risk of penalties associated with non-compliance. Understanding how to maintain due diligence and regulatory compliance is crucial for avoiding the severe financial repercussions of noncompliance with NERC regulations, which can lead to reputational harm and penalties of up to $2,000,000 daily. This financial inspection is critical to the decision-making processes for asset acquisition. The analysis also reviews market conditions and regulatory impacts on asset valuation, ensuring the investment is sound and aimed at a satisfactory return. The evaluation typically encompasses the direct financial outputs and the potential costs associated with NERC compliance and future technological updates.

Related Articles for Penalties:

Data Exposure by Vendor Leads to $2.7 Million NERC Penalty for Utility

How Can Certrec Help?

Certrec offers regulatory due diligence services for entities considering the acquisition of new generating assets. Certrec identifies and mitigates regulatory risks hidden in a generation asset bundle. This process includes evaluating the compliance histories and statuses of targets, assessing the risks associated with asset acquisition, and providing due diligence activities such as reviewing compliance documentation and creating an internal compliance program. Our approach aims to prevent potential fines and other issues related to non-compliance with regulations, potentially saving millions in daily NERC compliance fines.

Conclusion

Thorough evaluations across technical, regulatory, and financial risks are crucial for making informed decisions when acquiring new generating assets. These assessments help align investments with future energy demands, technological progress, and NERC standards, ensuring sustainable and successful integration into the energy grid. Certrec’s expertise in regulatory risk mitigation further enhances the strategic value of regulatory due diligence processes, protecting investments, and facilitating compliance.

Disclaimer: Any opinions expressed in this blog do not necessarily reflect the opinions of Certrec. This content is meant for informational purposes only.