WWW.UTILITYDIVE.COM

But co-location agreements between existing nuclear facilities and data centers should be scrutinized for potential impacts on other customers, said Tony Clark, a former FERC commissioner.

Dive Brief:

- Rapidly increasing electricity demand from data centers and artificial intelligence could be a boon to the nuclear industry, drawing the necessary investment to spur development of small modular reactors, Jim Robb, president of the North American Electric Reliability Corp., said Wednesday in a discussion hosted by the United States Energy Association.

- But there are risks associated with the rising demand, including co-location agreements between data centers and existing nuclear facilities that keep scarce electricity supplies out of regional markets, Tony Clark, a senior advisor at the law firm of Wilkinson Barker Knauer and former commissioner with the Federal Energy Regulatory Commission, told a House subcommittee on Tuesday.

- U.S. data center electricity demand could double by 2030 to consume 9% of U.S. electricity generation, the Electric Power Research Institute found in a May study. The increase is being driven by AI applications which require 10 times the electricity of traditional internet searches.

Dive Insight:

Data centers “truly are the backbone of today’s economy … making them really critical to society,” Christopher Wellise, vice president for sustainability at internet services company Equinix, said at Wednesday’s USEA event.

But the rapidly-growing load is also a challenge for grid operators. U.S. data centers are expected to require nearly 21 GW this year, up from 19 GW in 2023 – and could consume 35 GW by the end of this decade, according a May FERC report.

“We just recently surveyed a lot of utilities here in the U.S. and globally, and we’re hearing data service requests on the order of 4 to 5 GW for co-located facilities,” said Daniel Brooks, corporate vice president of integrated grid and energy systems at the Electric Power Research Institute, at the USEA event. “That’s a significant requirement in terms of supply and delivery capacity that has to be planned, permitted and constructed.”

The grid can expand to accommodate that load, but there are issues with the timing, Brooks said. A data center can be stood up in one to three years, he said, while new generation or transmission can take much longer.

Data center load is having “a huge impact,” said David Schleicher, president and CEO of the Northern Virginia Electric Cooperative, said at the USEA event.

“We were a 1,000 MW cooperative about six years ago. We’re now a 2,000 MW cooperative on the way to about [8,000 MW], Schleicher said. “It is our engine of growth. Northern Virginia was residential and commercial. Now it’s data centers.”

“A data center can build their facility in about a year and a half, but it takes me about four years to build a substation,” he added.

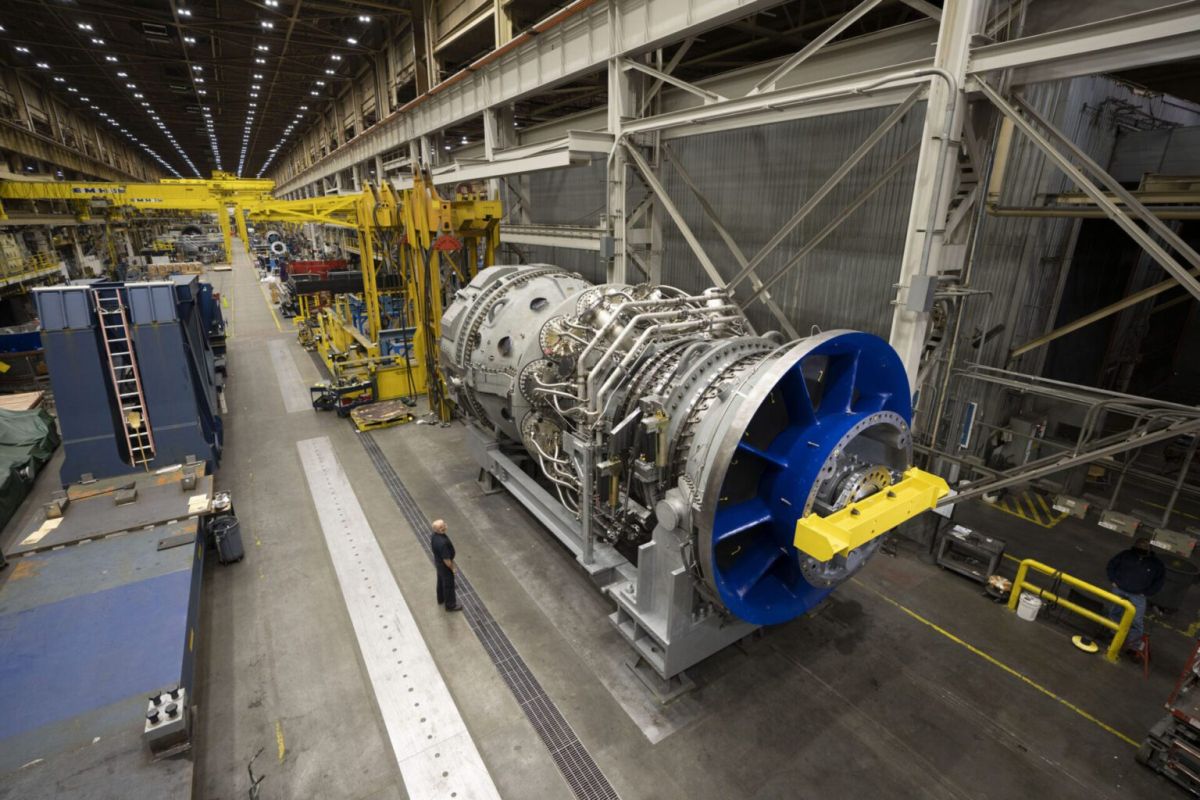

The nuclear sector could be the solution for data center demand, said NERC’s Robb.

“One very positive development is the data center interest in nuclear, and potentially in advancing the development of small modular reactors. That’s got to be a big part of our low-carbon future,” Robb said. “Getting guys like [Bill] Gates and [Jeff] Bezos and Facebook and Meta … that have gobs and money to really push that technology and get that into a commercializable form, I think, will serve this country incredibly well.”

Nuclear energy “is a promising candidate to meet these growing demands,” Shawn Rosemarin, vice president of customer engineering R&D at Pure Storage, said in an email. But it is also “expensive, complex and filled with challenges.”

“The immediate need for power to support AI infrastructure already surpasses the grid capacity in many geographies,” Rosemarin said. “While traditional nuclear power may be an option for those that can afford it, emerging nuclear technology (i.e. nuclear fusion) is likely still a decade away. This calls for a strategic approach to energy management that goes beyond immediate fixes and considers long-term sustainability and scalability.”

Robb said he doubts all of the load growth being forecast today will materialize, as both AI-enabling chips and algorithms become more efficient.

“We saw this with the internet,” he said, “In the 90s and early 2000s we had similar concerns around electricity demand that largely didn’t actually occur because the chips got better, the algorithms got better. We will see something similar happen with the AI chips as well, I’m sure. … We’re going to see load growth, but it’s probably not as dramatic as we think right now.”

Data centers looking to come online faster are co-locating their facilities alongside existing generation, said WBK’s Clark at the House Energy, Climate, and Grid Security Subcommittee hearing on AI’s power demands.

“The emergence of data center co-location at existing generation facilities is a business arrangement that raises questions that should be explored regarding issues of basic fairness for all customers on the grid,” Clark said Tuesday.

The co-location arrangements “have typically been in coordination with an existing nuclear unit,” Clark said, adding that there is no reason they cannot happen with existing fossil units. The strategy is being employed in states that have fully unbundled their utilities and that are operating inside of organized wholesale markets.

“Under such an arrangement, the data center is directly served by an existing generator, taking some portion of the unit’s capacity out of the supply stack that was otherwise serving all customers in a regional grid,” he said. “Regulators and policymakers must scrutinize how these deals will impact other customers and the public interest at-large.”