WWW.POWER-TECHNOLOGY.COM

Shell is reducing its offshore wind investments and restructuring its power division following a comprehensive review, according to a report by Reuters.

The move reflects CEO Wael Sawan’s strategy to emphasise high-return activities, reducing costs in low-carbon and renewable sectors while focusing on oil, gas and biofuels.

A Shell spokesperson stated: “While we will not lead new offshore wind developments, we remain interested in offtakes where commercial terms are acceptable and are cautiously open to equity positions if there is a compelling investment case.”

The shift comes as the offshore wind sector faces challenges such as rising costs and supply chain issues.

Shell’s decision aligns with similar strategies by BP and Equinor, who have also slowed renewable investments due to investor pressure for higher returns. The energy shock from Russia’s invasion of Ukraine and declining profitability in renewables have influenced these decisions.

According to the report, Shell will continue with existing offshore wind projects but has withdrawn from several projects, including those located in South Korea and the US.

The company plans to split its power division into two units: power generation and trading, as announced by Shell Energy boss Greg Joiner.

“These two parts of our business will work closely together. In line with our simplification drive, the change is aimed at improving focus, accountability and delivery,” the spokesperson stated.

Greg Joiner will lead Shell Power, while David Wells will head Shell Energy, the report stated. Shell will focus on power sales and battery storage development.

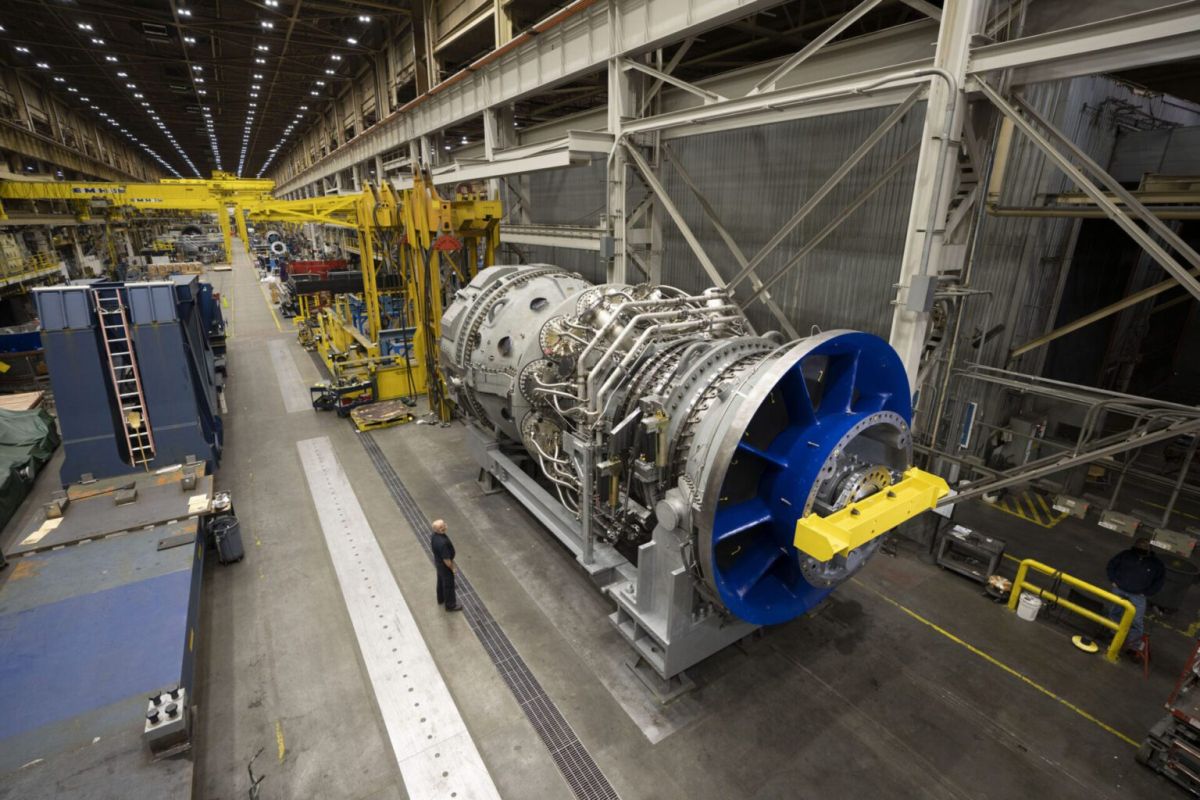

The spokesperson continued: “In selected markets, we see increasing value in using batteries and flexible gas-fired power plants to manage intermittency and help us to meet our customers’ needs as renewables play increasing roles in power markets.”

Shell currently operates 3.4GW of renewable capacity globally and sold 279 terawatt hours of electricity in 2023.

As a key element of Sawan’s strategy, Shell is focused on expanding its liquefied natural gas division while working to stabilise oil production by the end of the decade.

Recent months have seen Shell scaling back in offshore wind, solar, and hydrogen, selling retail power businesses, refineries and some oil and gas production.

In March 2024, Shell modified its carbon reduction targets, citing high gas demand and uncertainties surrounding the energy transition and sparking concerns among climate-conscious investors.